Fed rate hike

Adjustable-rate loans such as ARMs that are no. A Fed Hike is an increase in the main policy rate of the US central bank called the US Federal Funds Target Rate.

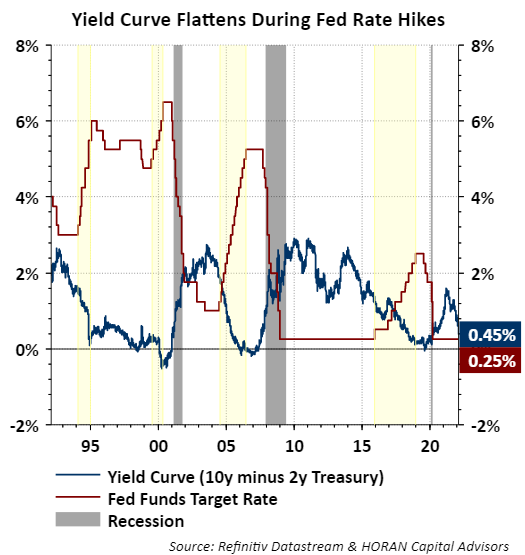

How High Can The Fed Hike Interest Rates Before A Recession Hits This Chart Suggests A Low Threshold Marketwatch

Published Wed Nov 2 2022 200 PM EDT Updated Wed Nov 2 2022 830 PM.

. During his post-meeting conference Fed Chair Jerome Powell signaled. The rate hike brings the federal funds rate to a targeted range of 375 to 4 the highest level since January 2008. The Fed said it anticipated further rate increases going.

That point of view. WASHINGTON AP The Federal Reserve pumped up its benchmark interest rate Wednesday by three-quarters of a point for a fourth straight time. Central bank raises the interest rate that banks charge each other.

The central bank has been bedeviled by. The Federal Reserve will raise interest rates just one more time in November before it stops due to a soaring US dollar according to market veteran Ed Yardeni. Fed approves 075-point hike to take rates to highest since 2008 and hints at change in policy ahead.

What Is a Fed Rate Hike. At the Feds Sept. Pricing of futures tied to the Feds policy rate implied a 92 chance that the Fed will raise its policy rate now at 3-325 to a 375-4 range when it meets Nov.

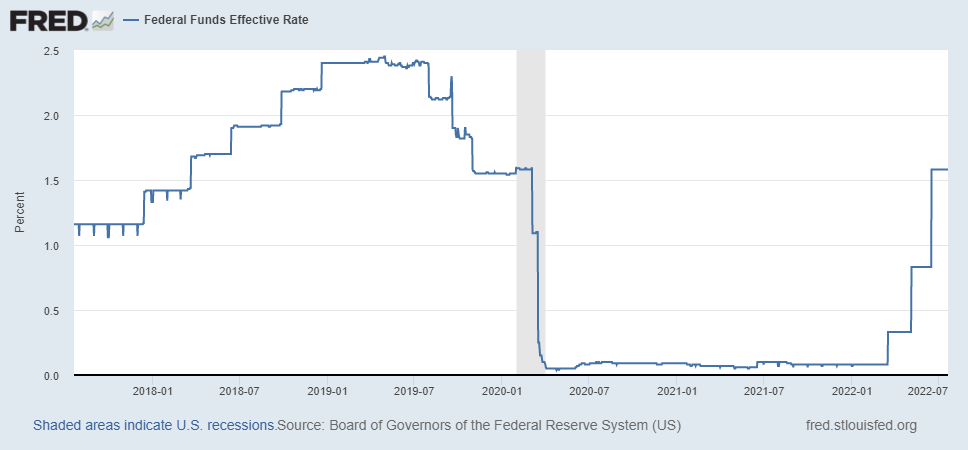

The latest hike moved the Feds target funds rate range to between 375 and 4 the highest since 2008. This type of rate hike occurs when the US. That means the 075 percentage-point hike on Wednesday will add an extra 75 of interest for every 10000 in debt.

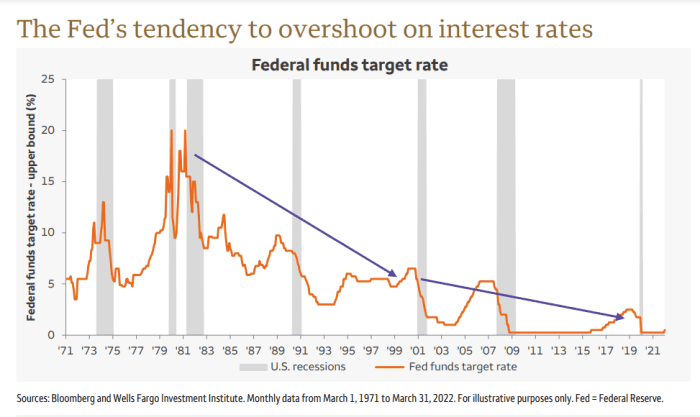

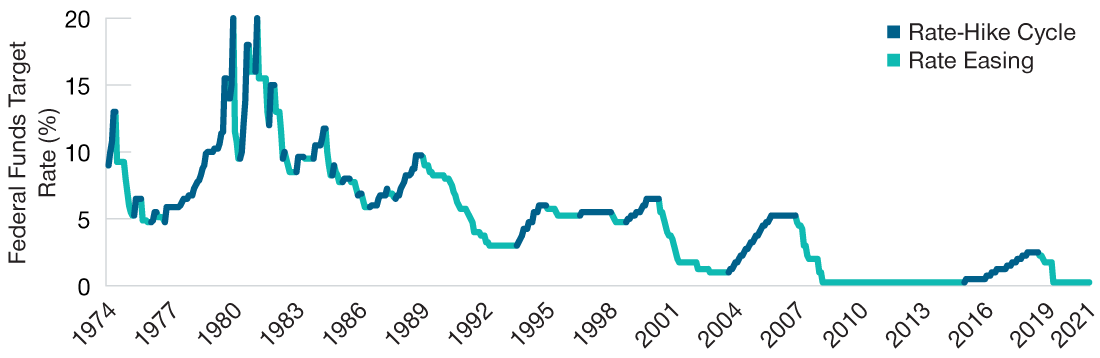

The rate hike is the sixth consecutive one this year for the Fed a cycle not seen since the inflation-fighting days of the early 1980s. For borrowers and consumers the fed rate hike means that many types of financing will cost more due to higher interest rates. The Federal Reserve on Wednesday enacted its second consecutive 075 percentage point interest rate increase as it seeks to tamp down runaway inflation without.

Prices rose by a hotter-than-expected 83 in August while core inflation a measure that excludes volatile food and energy prices jumped by 63. The Federal Reserve ordered another big boost in interest rates on Wednesday and warned that rates will have to. Powell announced another interest rate hike on Wednesday.

Rate futures markets now imply. 20-21 meeting the median estimate among policymakers pegged the peak fed funds rate next year at between 450 and 475. The Federal Reserve will raise interest rates as high as 46 in 2023 before the central bank stops its fight against soaring inflation according to its median forecast released.

News Corp is a global diversified media and information services company focused on creating and distributing authoritative. Rate hikes are associated with the peak of the economic cycle. Fed officials signaled the intention of continuing to hike until the funds level hits a terminal rate or end point of 46 in 2023.

The Federal Reserve announced it was raising its key rate by another 075 percentage points lifting the target range to between 3 and 325. Officials approved a third straight 75 basis point rate hike in September lifting the federal funds rate to a range of 30 to 325 near restrictive levels and showed no signs. The Federal Reserve raised interest rates 75 basis points on Wednesday bringing its federal funds rate target to a range of 375 to 4.

The Feds target policy rate is now at its highest level since 2008 - and new projections show it rising to the 425-450 range by the end of this year and ending 2023 at. That implies a quarter-point rate rise next year but. AP PhotoJacquelyn Martin File.

More specifically this refers to the rate at. The Wall Street Journals full markets coverage. So far the Feds five hikes in 2022 have increased rates by a.

Federal Reserve Approves Its Third Rate Hike Of The Year

What Does The Federal Reserve Interest Rate Hike Mean To You Bayntree Wealth Advisors

:no_upscale()/cdn.vox-cdn.com/uploads/chorus_asset/file/24042678/UzzuD_the_fed_has_been_raising_interest_rates_for_months.png)

The Fed Raised Interest Rates Again What Does That Mean For The Economy And Inflation Vox

Fed Raises Interest Rates Keeps Forecast For 3 Hikes In 2018

With Federal Reserve Poised For Another 75 Bp Rate Hike What S Next Seeking Alpha

Investors Expect A Faster Pace For Fed Rate Hikes Cnbc Survey Shows

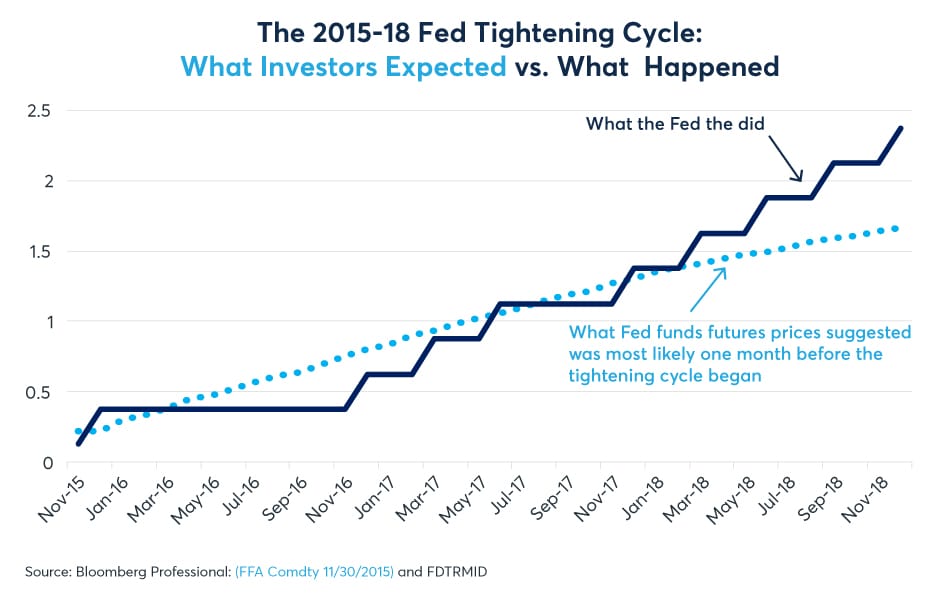

Putting The Fed S Planned Rate Hikes Into Context T Rowe Price

Treasury Two Year Yields Climb Relentlessly Toward 4 Before Fed

Fed Rate Hikes And Recessions Horan

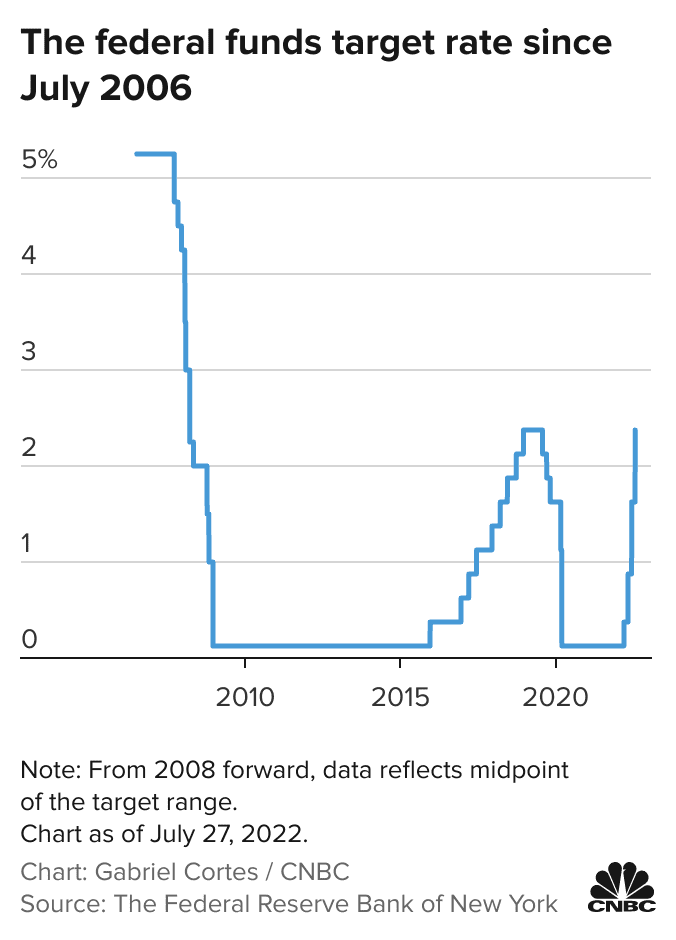

Fed Decision July 2022 Fed Hikes Interest Rates By 0 75 Percentage Point

Fed Rate Hikes Expectations And Reality Benzinga

6 Strategies To Predict The Chance Of A Fed Rate Hike In 2022 Dttw

The Fed Is Raising Rates Here S How Markets Have Performed In The Past Northwestern Mutual

Fed Barrels Toward Another 75 Basis Point Rate Hike As High Inflation Persists Fox Business

September Jobs Report Could Solidify Another Super Sized Fed Rate Hike Fox Business

Market Expectations Grow For Early Fed Rate Hike As Inflation Rises S P Global Market Intelligence

Don T Worry Too Much About A Fed Interest Rate Hike Fivethirtyeight